Date: Friday 17th September 2021

Speaker: Ian Marsh, Partner

Business: St James’s Place Wealth Management

Topic: Personal & Family Protection

1. Think about yourself as an asset

A 30-year-old earning £30,000 pa will earn £1.125m over a lifetime.

Increasingly, there is very little by the way of a state safety net underpinning these earnings, and post-pandemic, companies have been scaling back benefits to the legal minimum.

For example, Statutory Sick Pay (SSP) offers:

- £96 per week for 28 weeks

- Is not available to the self-employed

2. What are your chances of needing protection

Risk Reality Calculator: www.riskreality.co.uk/gen

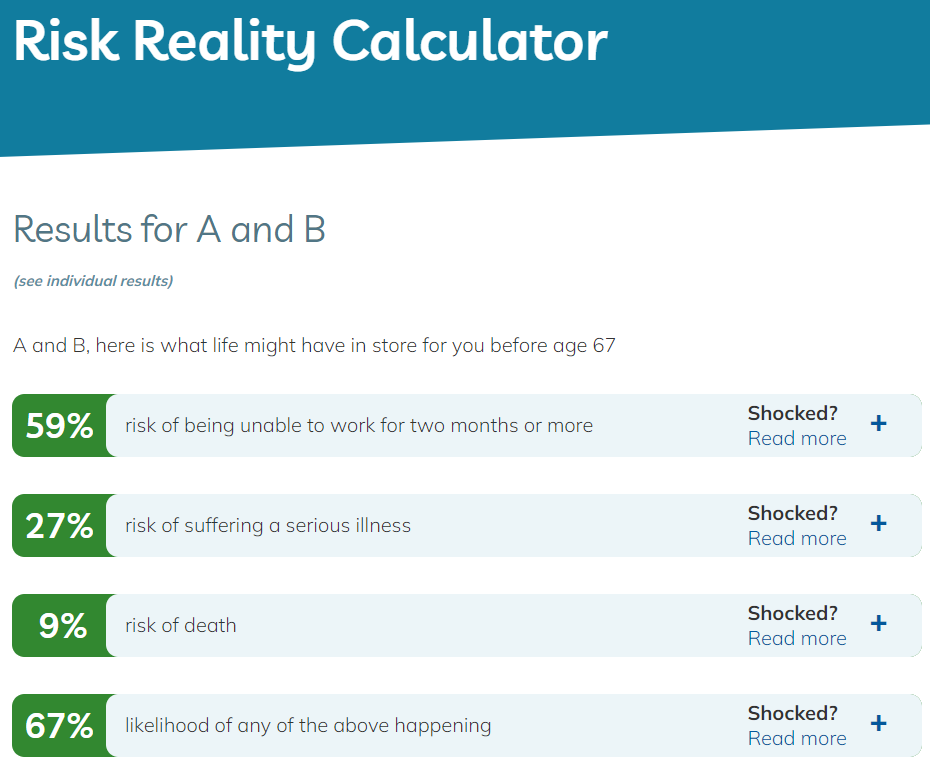

For example, a couple who are both non-smokers aged 30-years’-old and looking to retire at 67, would have a 2-in-3 chance of requiring some form of protection before retirement:

If you change both of these individuals to smokers, the risks of requiring some form of protection jumps from from 67% to 80%, with the individual risks worsening as follows:

- Risk of being unable to work >2m (Income protection cover): 70%

- Serious illness (Critical illness cover): 37%

- Risk of death (Life cover): 21%

- Any of the above: 80%

3. The Pandemic has focused minds

Many of us consider ourselves to be immortal…that is, until something ‘bad’ happens to a relative, somebody we know, or (in the case of COVID) becomes a real and present danger.

Hence, whilst life cover (relatively cheap) is the most common form of protection undertaken (being a mortgage requirement), critical illness or income protection cover are far less commonly held (being more likely to happen and therefore more expensive).